Time line

Research and competitor analysis

Analyzing the websites of various banks, it’s evident that there are notable differences in terms of functionality, clarity of information, and overall user-friendliness. These aspects play a crucial role in shaping the user experience and satisfaction levels. For an upcoming banking app project, it becomes imperative to critically assess these points to ensure that the designed solution not only meets user expectations but also stays competitive within the market landscape. This initial analysis sets the stage for developing a robust and user-centric application that addresses the diverse needs of modern banking customers.

Strengths:

Precise Location: The website allows for precise search of branches and ATMs on a map, which is useful for users.

Contact Information: Each branch has detailed contact information listed, making it easy for users to find necessary details.

Weaknesses:

Lack of Filtering: There is no option to filter branches based on specific criteria, which may make it difficult for users to find the desired branch.

Lack of Interactivity: The website is somewhat static and lacks interactive features that could enhance user experience.

Strengths:

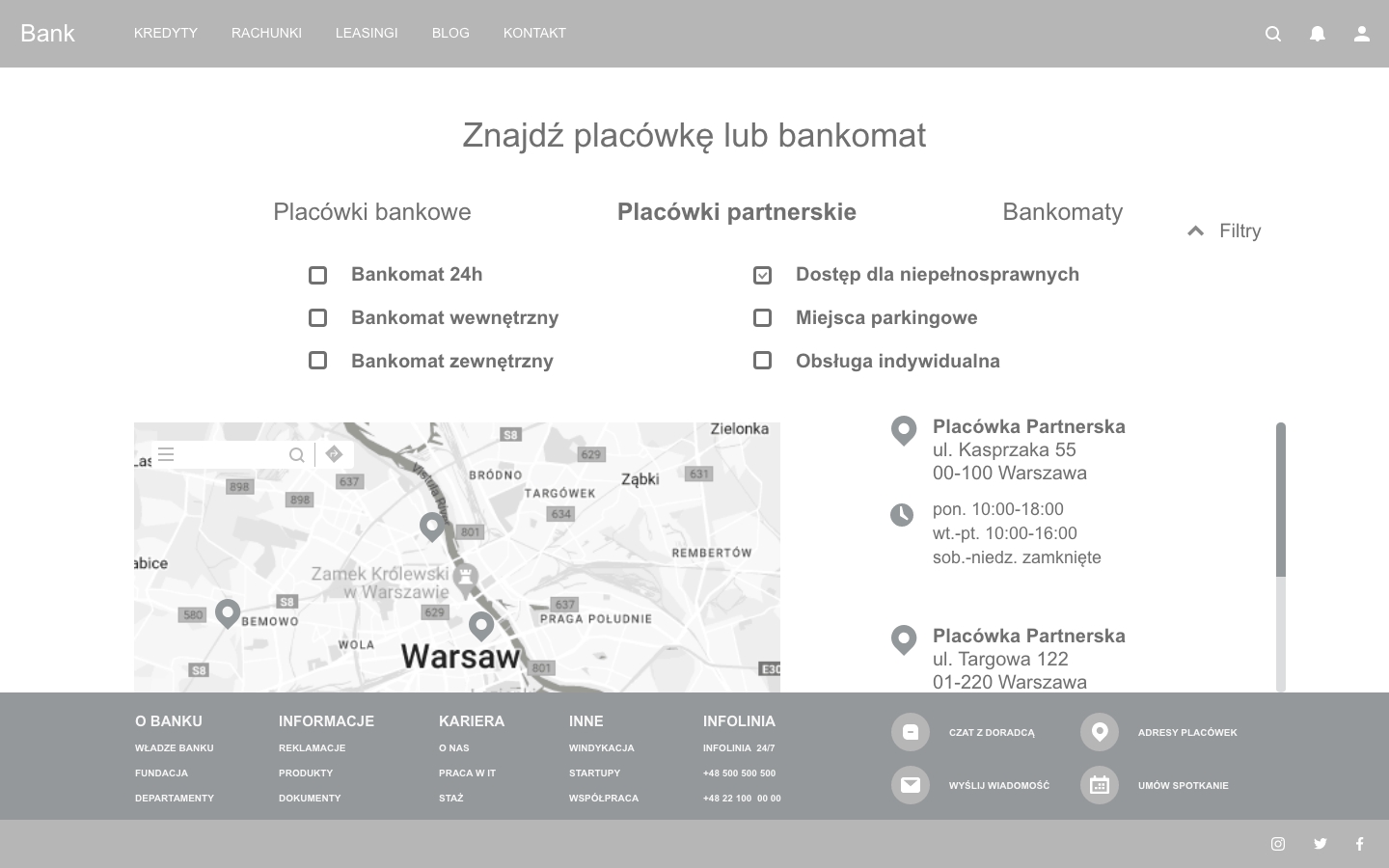

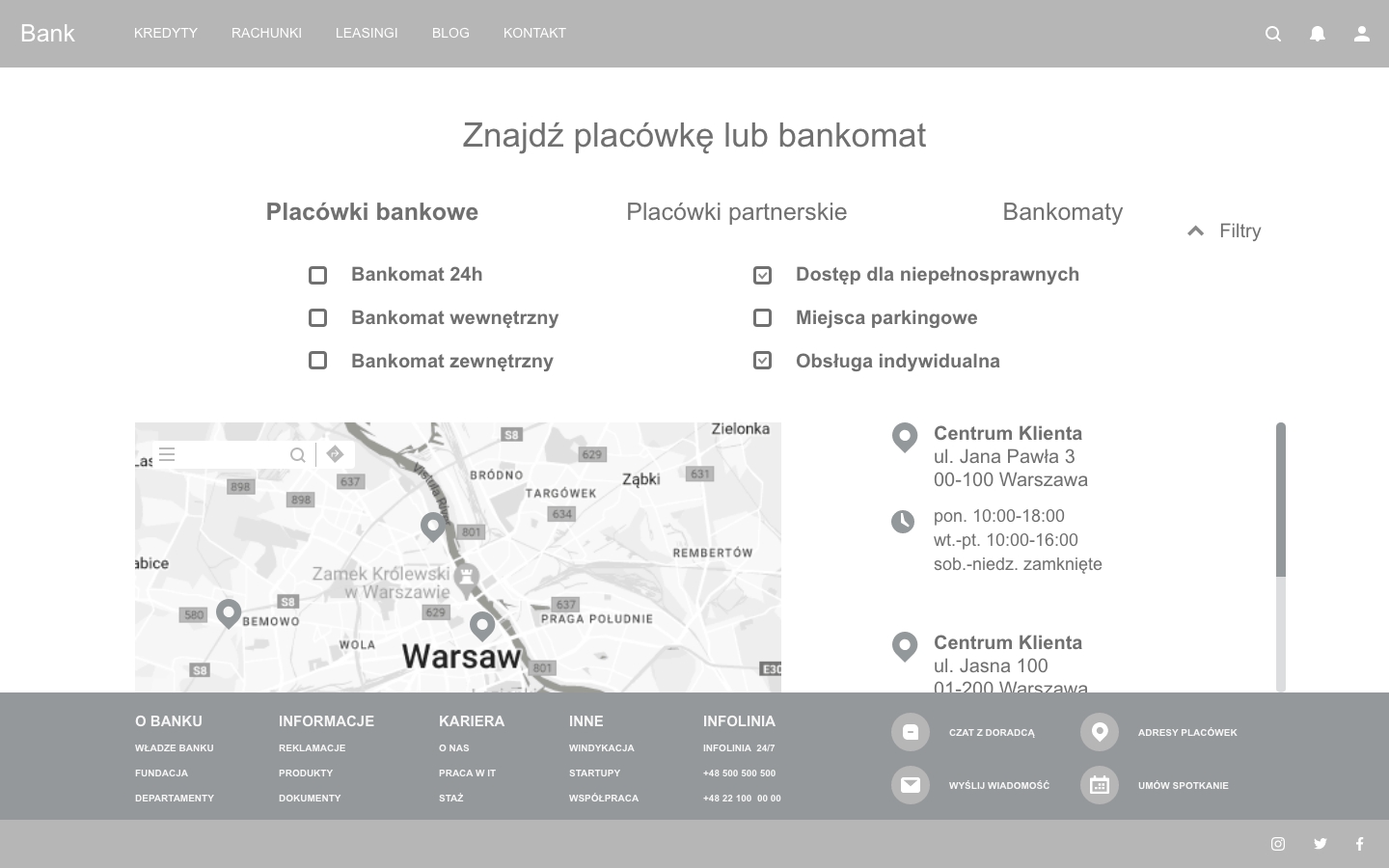

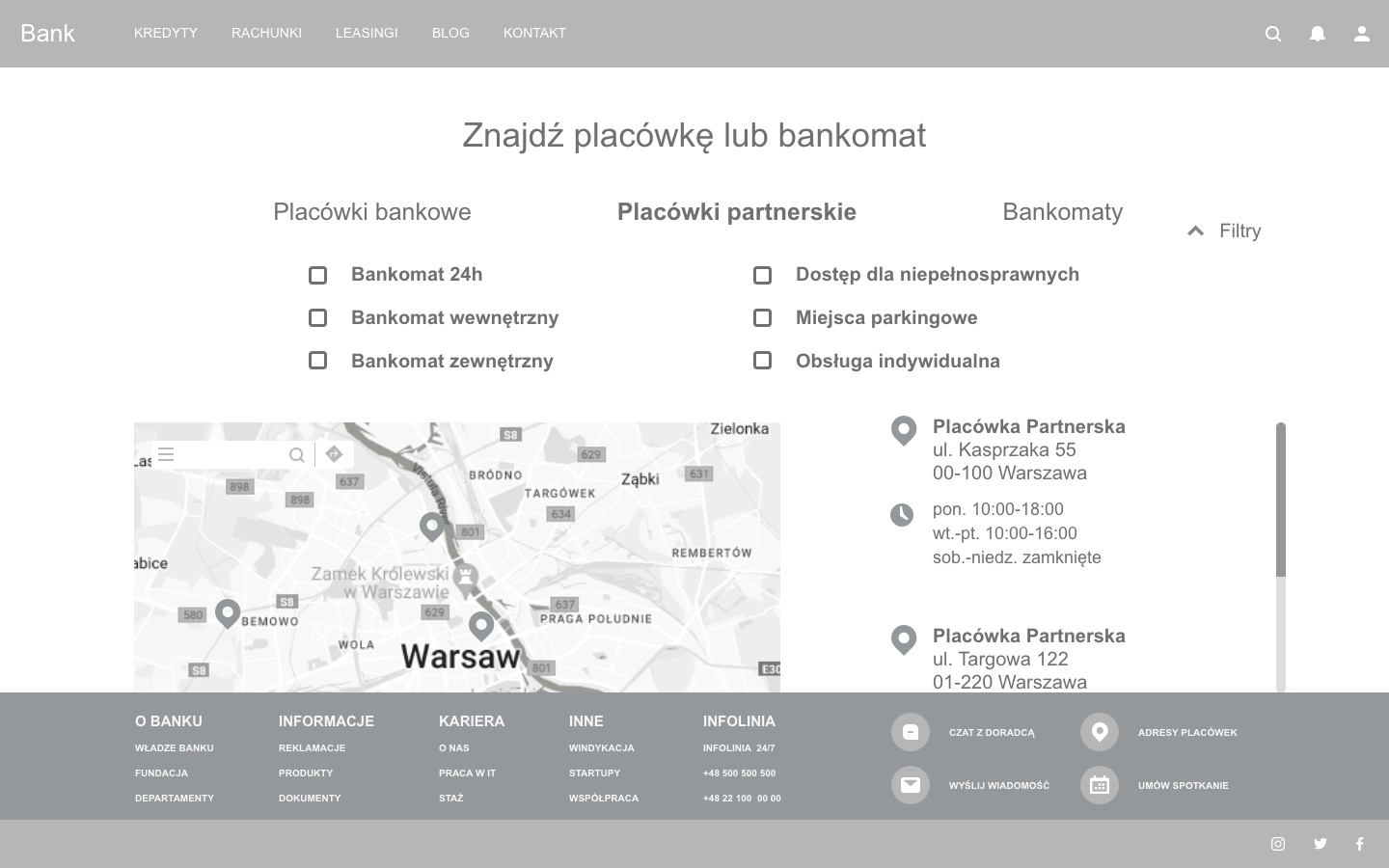

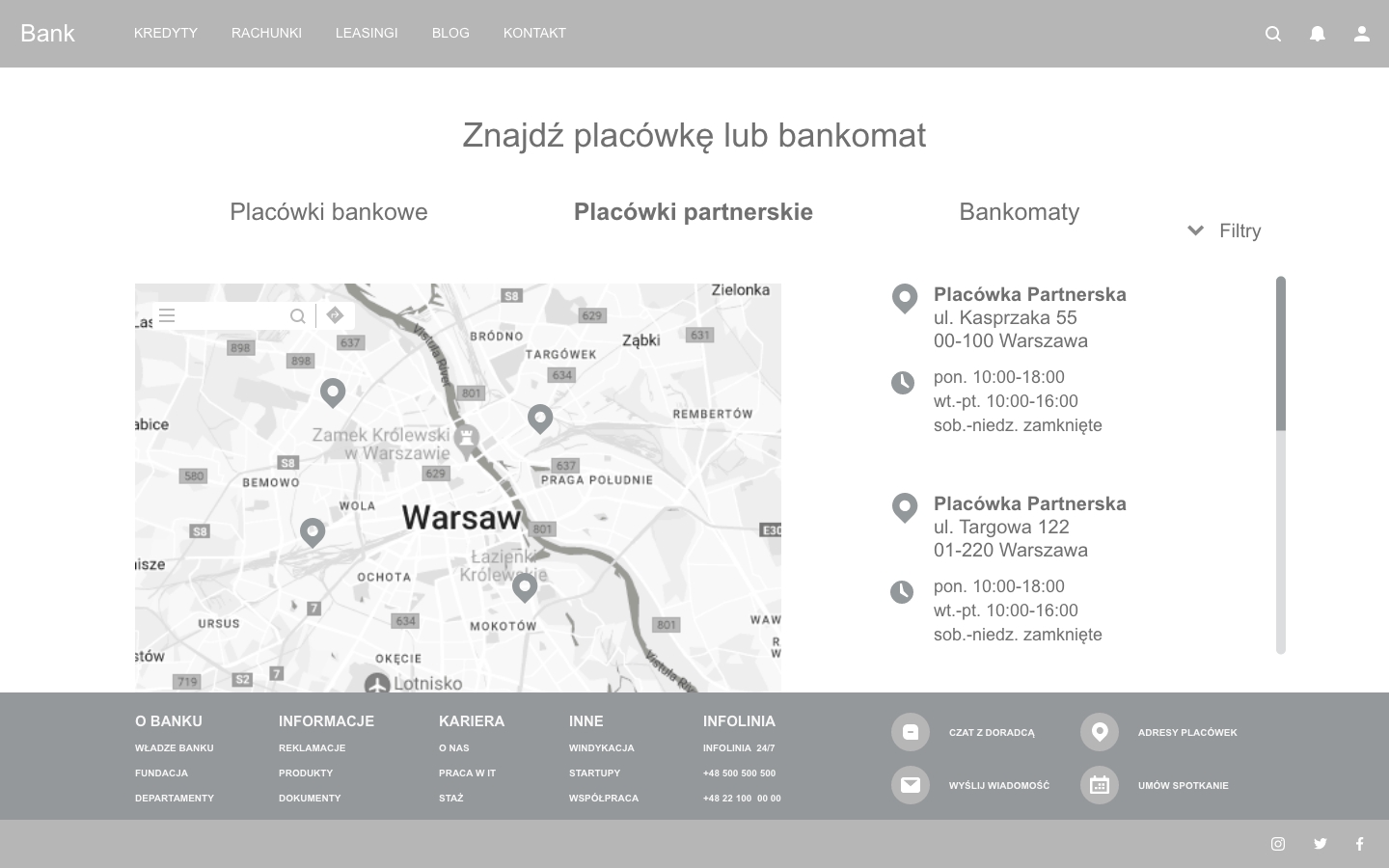

Filtering Options: The website allows filtering of branches based on different categories, making it easier for users to find the right place.

Comprehensive Information: Each point has full information provided, including opening hours and contact details, which is helpful for customers.

Weaknesses:

Less Intuitive Navigation: Some users may find the navigation on the website less intuitive compared to other services.

Less Detailed Information: Some points could include more detailed information, such as accessibility for people with disabilities.

Strengths:

Regional Division: The website is divided into regions, making it easier to locate branches for users from different parts of the country.

Map with Locations: Similar to other websites, Bank Pekao offers a map with branch locations, which is convenient for users.

Weaknesses:

Lack of Filtering: The ability to filter would be useful for users, especially in large cities.

Limited Information: Some points may have limited information available, which can make it challenging for users to find complete data.

Strengths:

Service Variety: Bank Millennium’s website showcases a variety of services available at branches, which can attract customers’ attention.

Appointment Scheduling: There is an option to schedule appointments at selected branches, which is convenient for customers.

Weaknesses:

Less Clear Map: The map on the website may be less clear for users compared to other sites.

Lack of Interaction: The absence of interactive features on the map or filtering options may hinder users in quickly finding the desired branch.

The research group

The research group consists of 10 individuals who regularly use banking applications to search for branches and ATMs. They have diverse experiences in mobile technology and online banking. The average age of participants is around 30 years, with a variety of educational backgrounds and professions, representing residents of major cities such as Warsaw, Gdańsk, and Łódź.

During the UX research, several key issues were identified as important to the study participants. Respondents expressed the need for quick and intuitive access to information about ATMs and bank branches. They often pointed out the lack of clarity in the interface and the absence of filtering options, which made it difficult for them to use the application effectively. Additionally, some participants highlighted the need for more detailed information on the availability of services for people with disabilities and the lack of personalization in terms of search preferences.

- Regular Users

- Diverse Technological Experience

- Average Age Around 30

- Diverse Educational Backgrounds

- Diverse Professions

- Representative of Major Cities

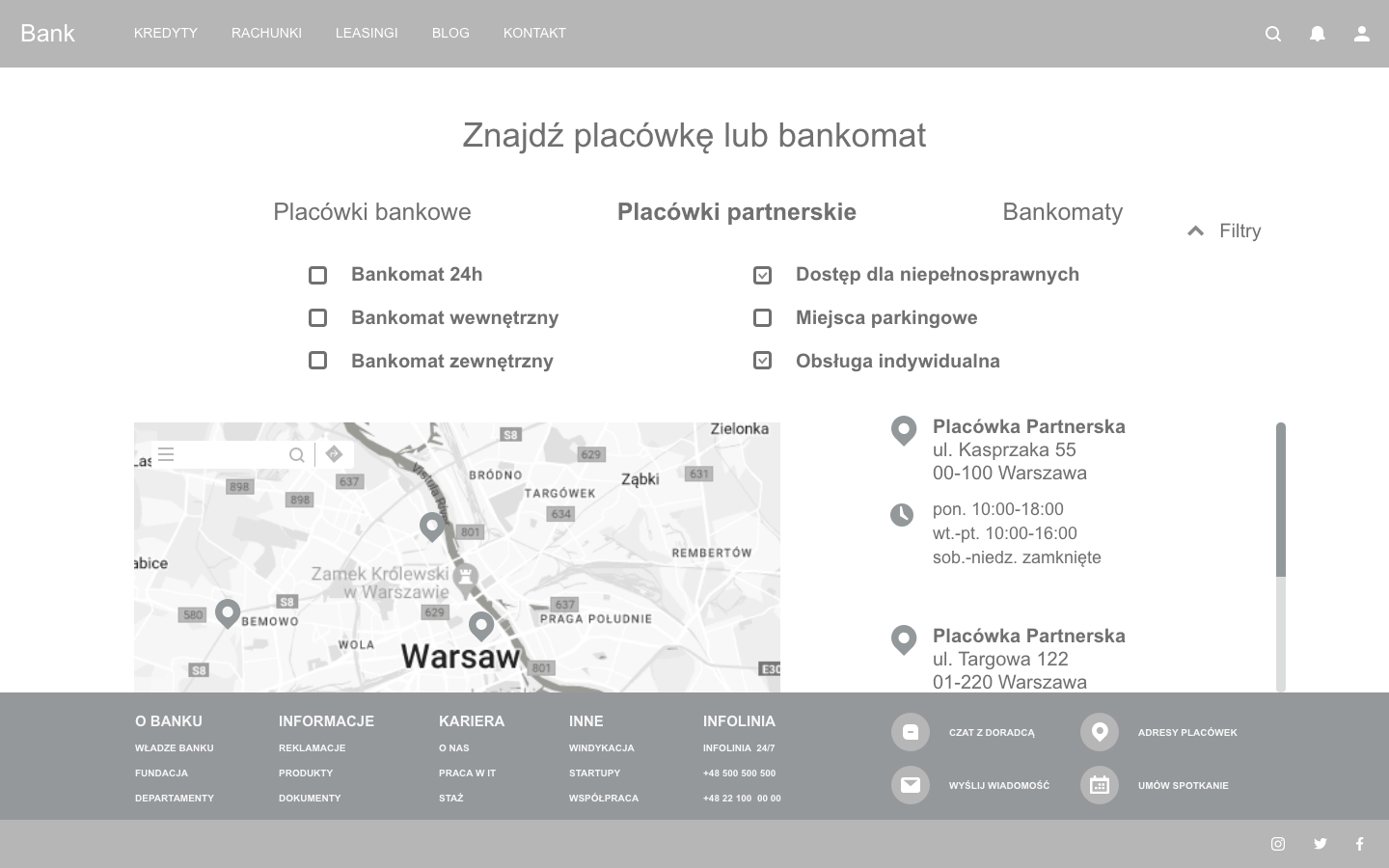

Guerrilla Testing

Guerrilla testing was conducted, focusing on swiftly assessing the usability of key project elements. The tests were carried out in person with 3-5 participants representing the target audience. The sessions involved tasks such as locating nearby ATMs and evaluating the ease of use in finding specific bank branches. Participants were encouraged to provide real-time feedback on their experience, highlighting areas of improvement such as interface clarity, navigation efficiency, and feature accessibility. The guerrilla testing approach facilitated quick insights into user interaction patterns and identified actionable areas for refinement in the design.

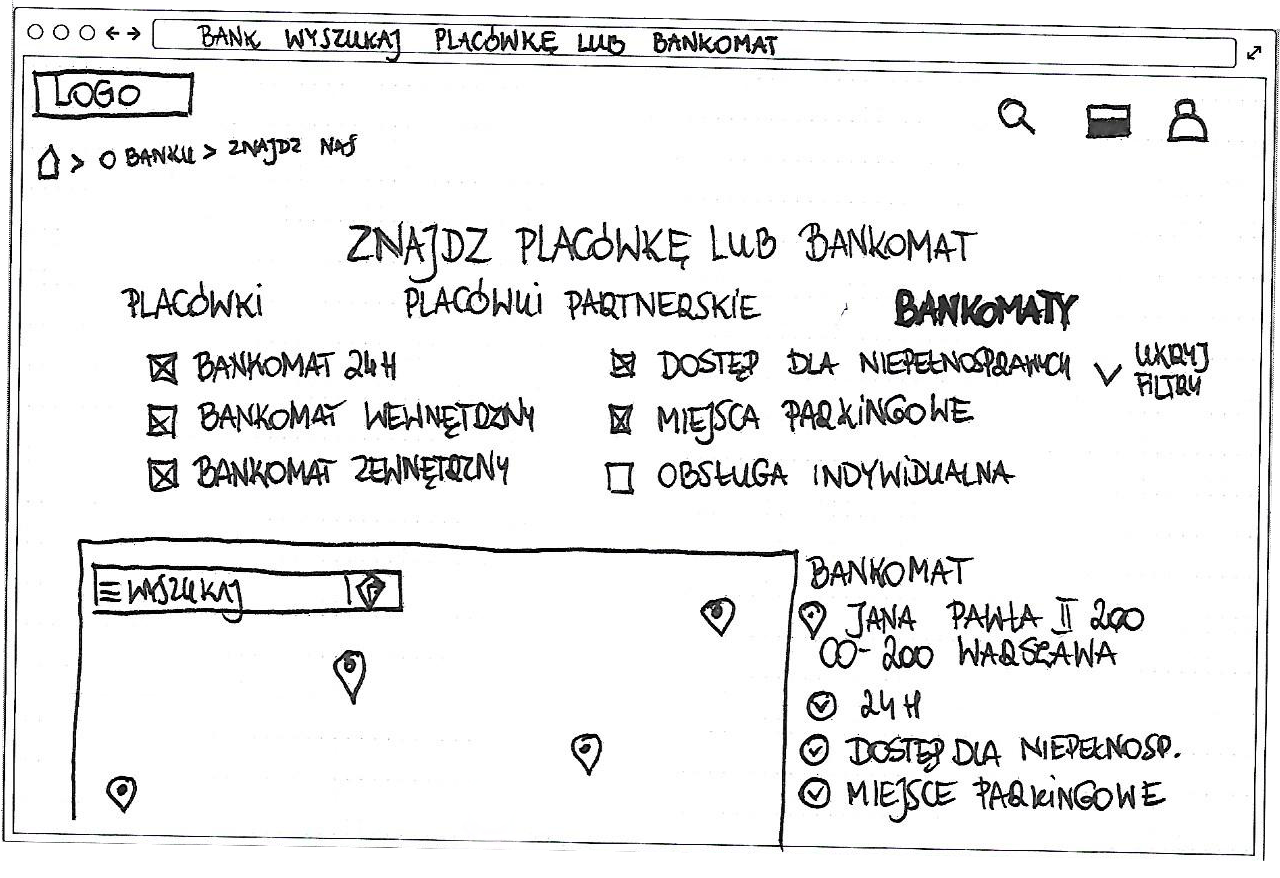

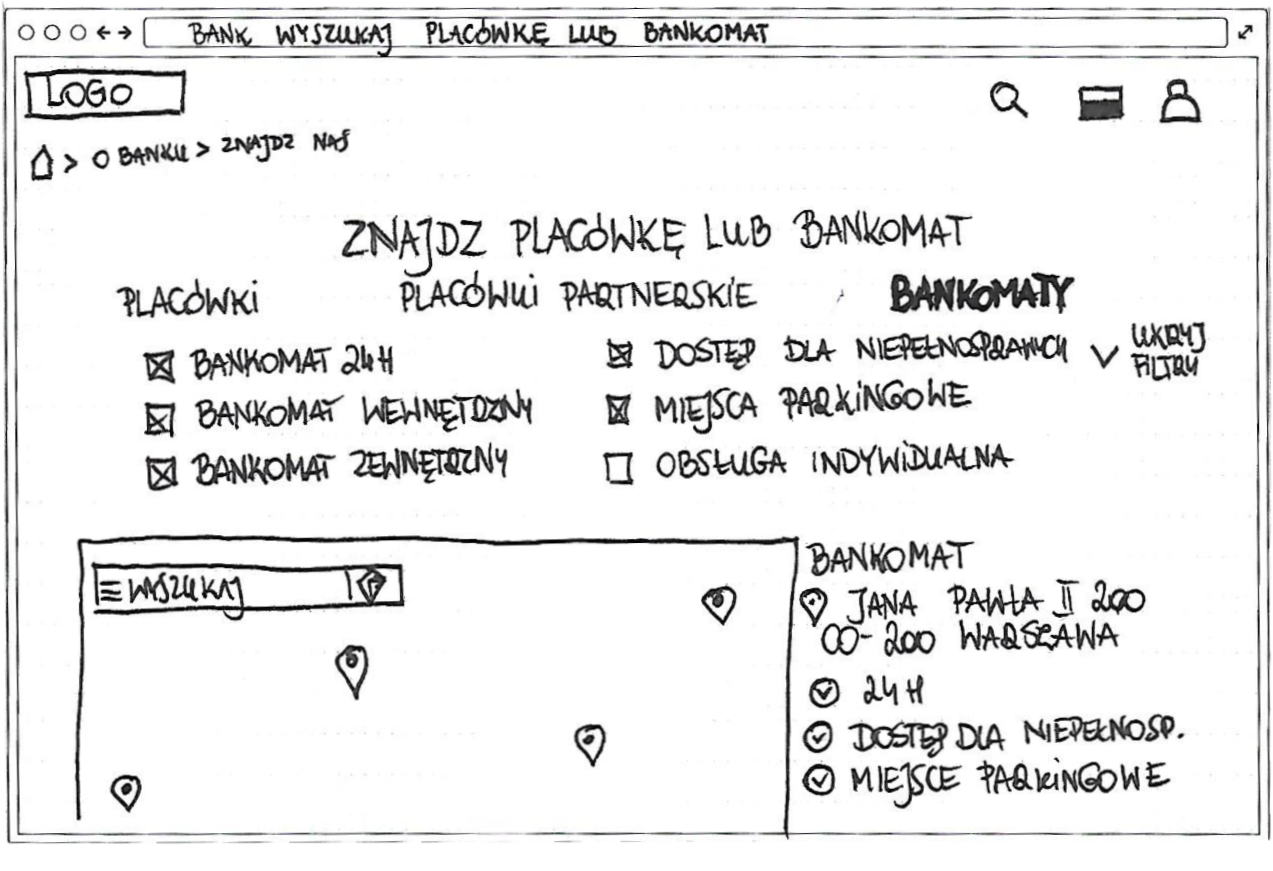

Step 1: Preparation of task scenarios

Defined the test objectives and developed key tasks for participants to perform during the sessions. Prepared task scenarios such as finding the nearest ATM, locating a cash-handling bank branch, checking accessibility for disabled individuals, etc., based on paper prototypes of the application

Step 2: Conducting testing sessions

Testing sessions took place in person with 3-5 participants representing the target user group of the application. Participants were asked to perform the defined tasks using the paper prototypes of the application. During the tests, participants were encouraged to express their thoughts, reactions, and suggestions regarding the prototypes.

Step 3: Analysis of results and insights

After completing the testing sessions, an analysis of the collected data was conducted, considering participants' reactions, opinions, and observations during the tests. Insights from the analysis included identifying issues and difficulties encountered by users while performing tasks on the paper prototypes, evaluating the usability of the application interface, and providing suggestions for improving functionality and clarity in the final version of the banking application.

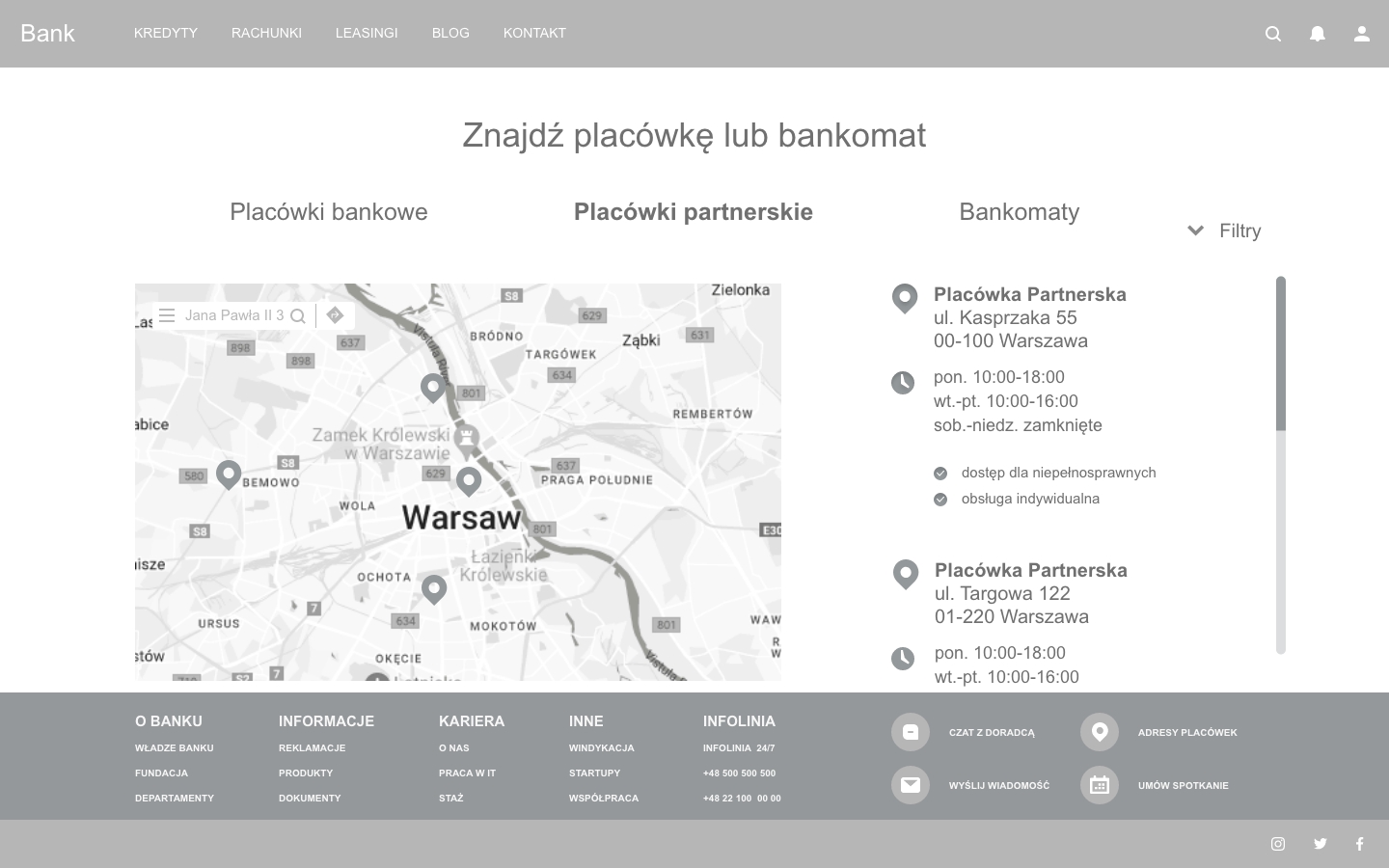

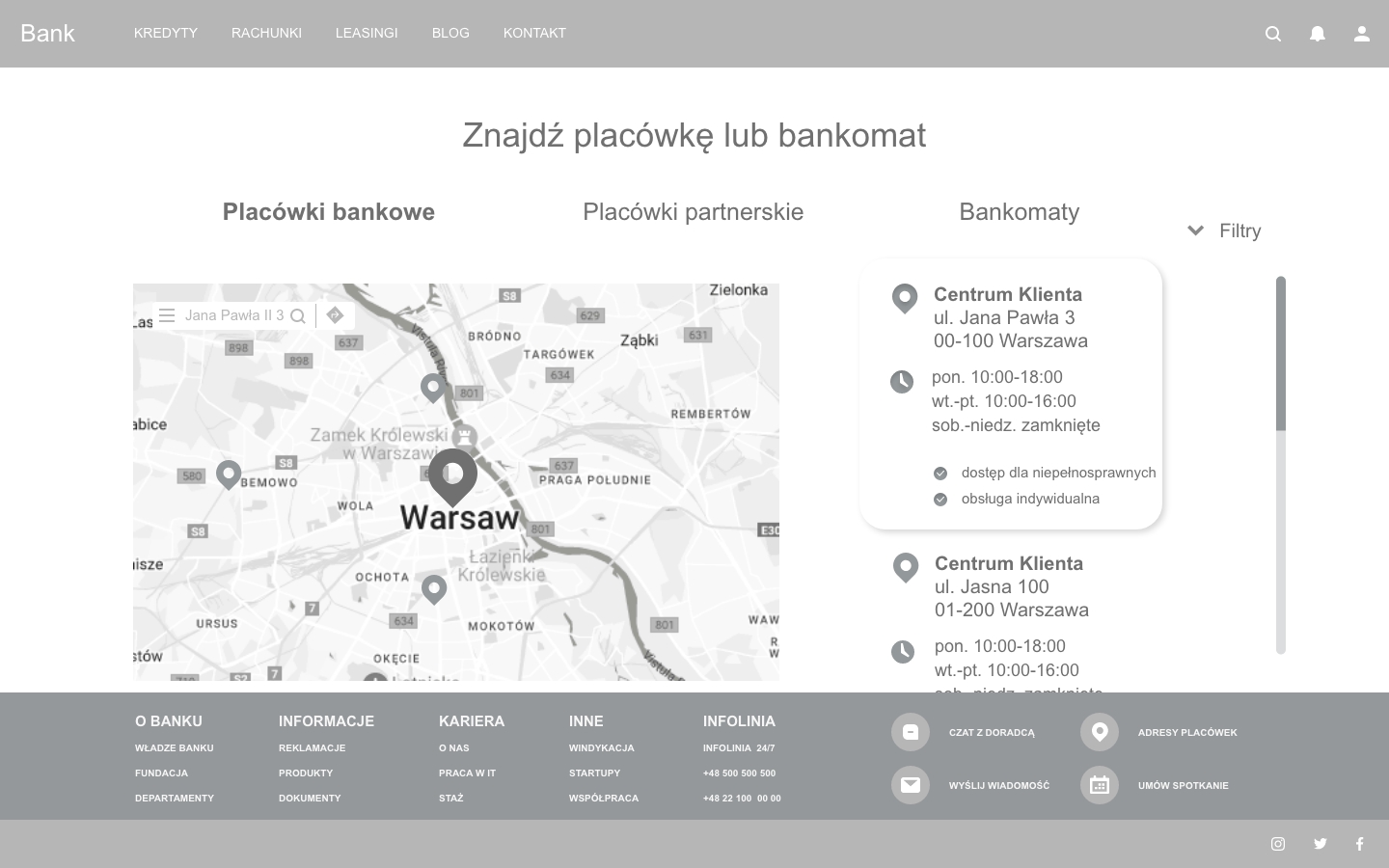

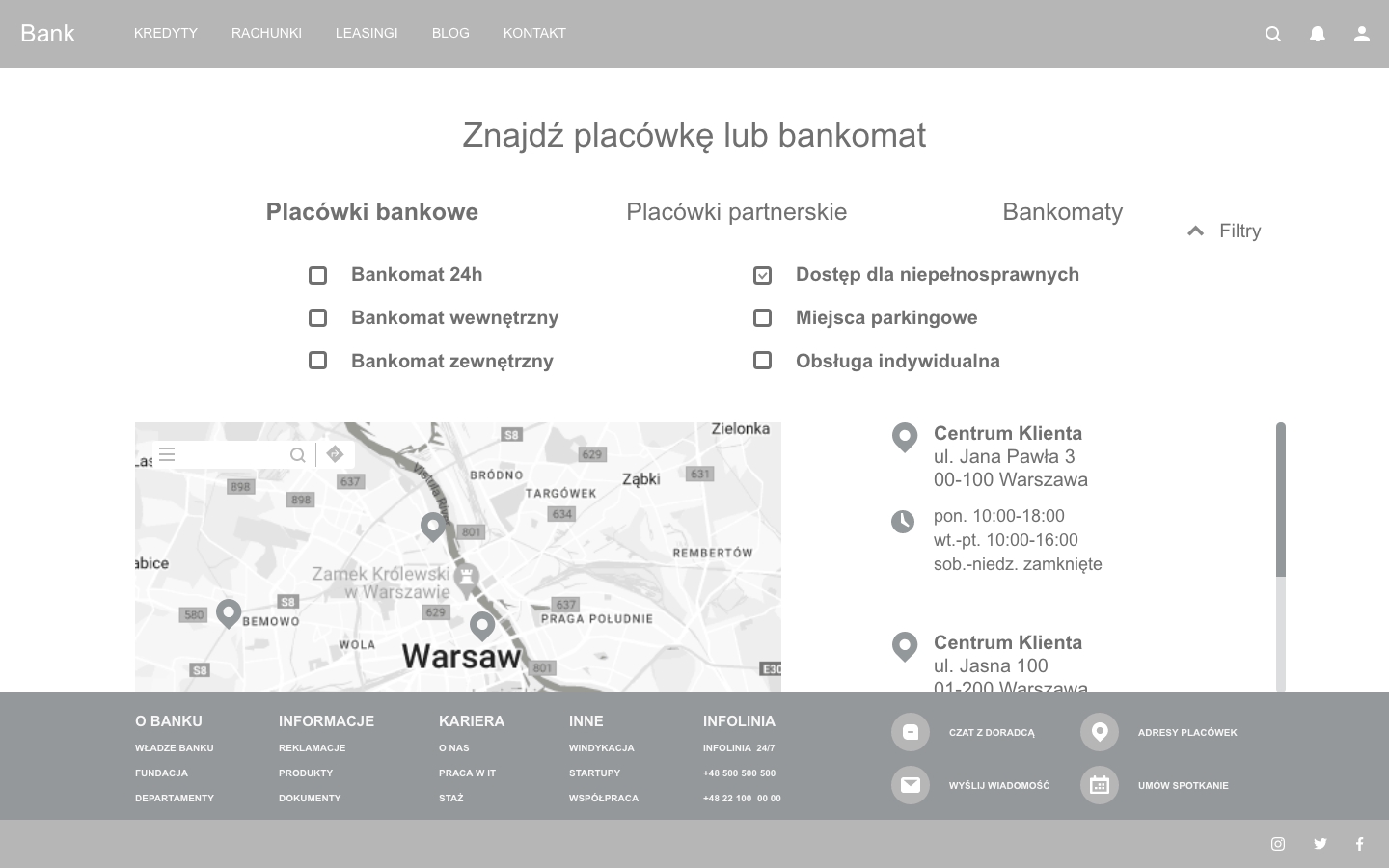

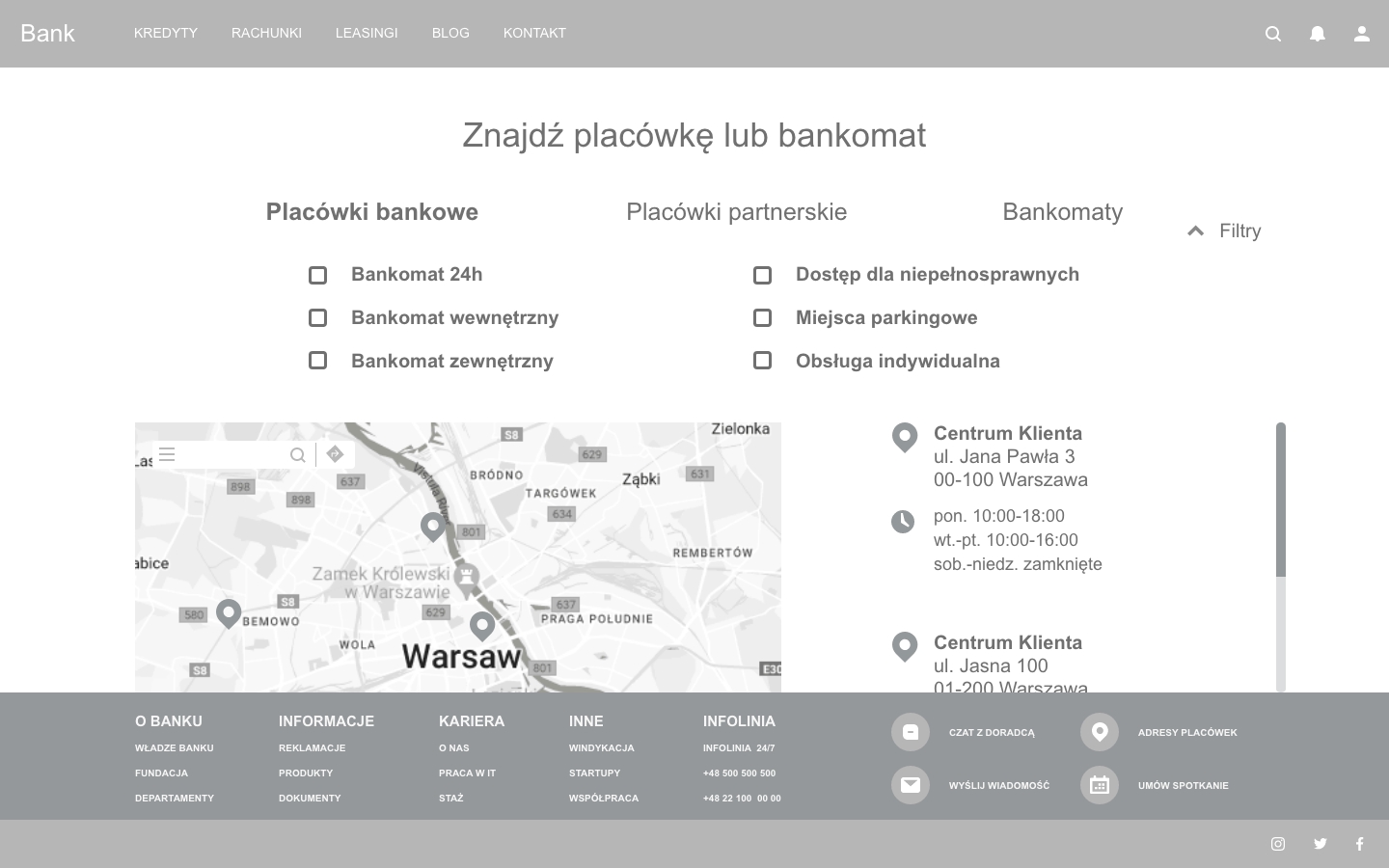

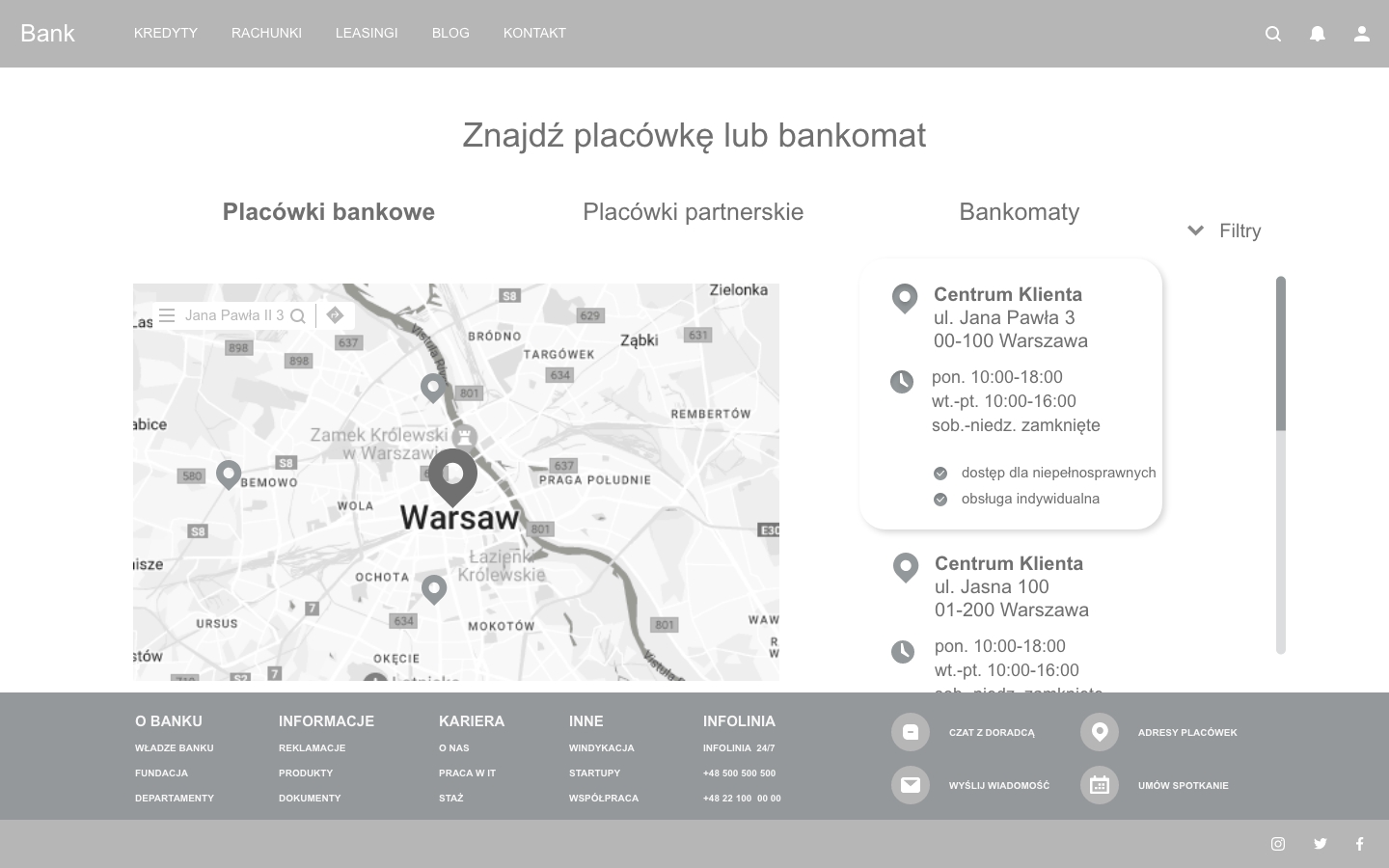

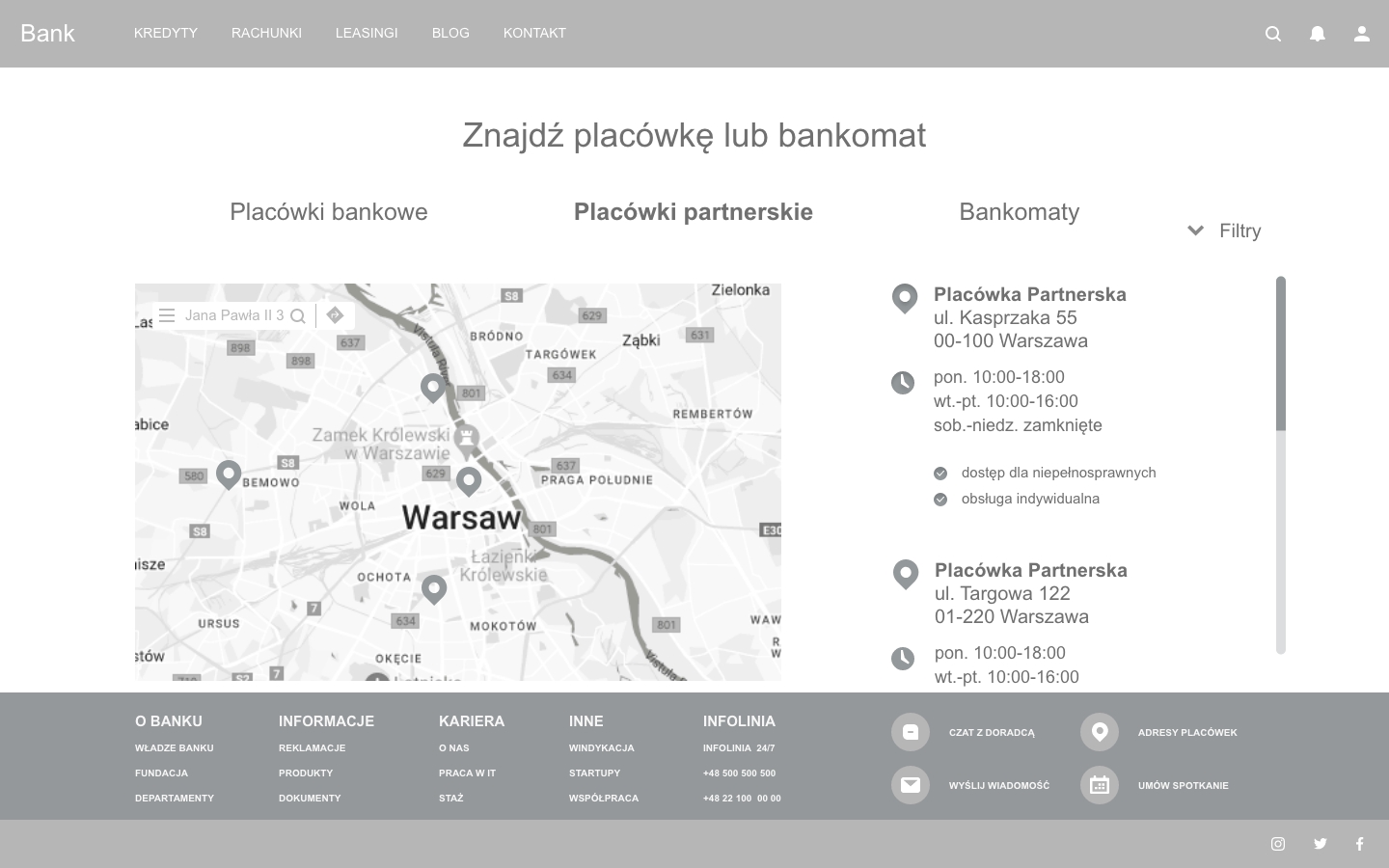

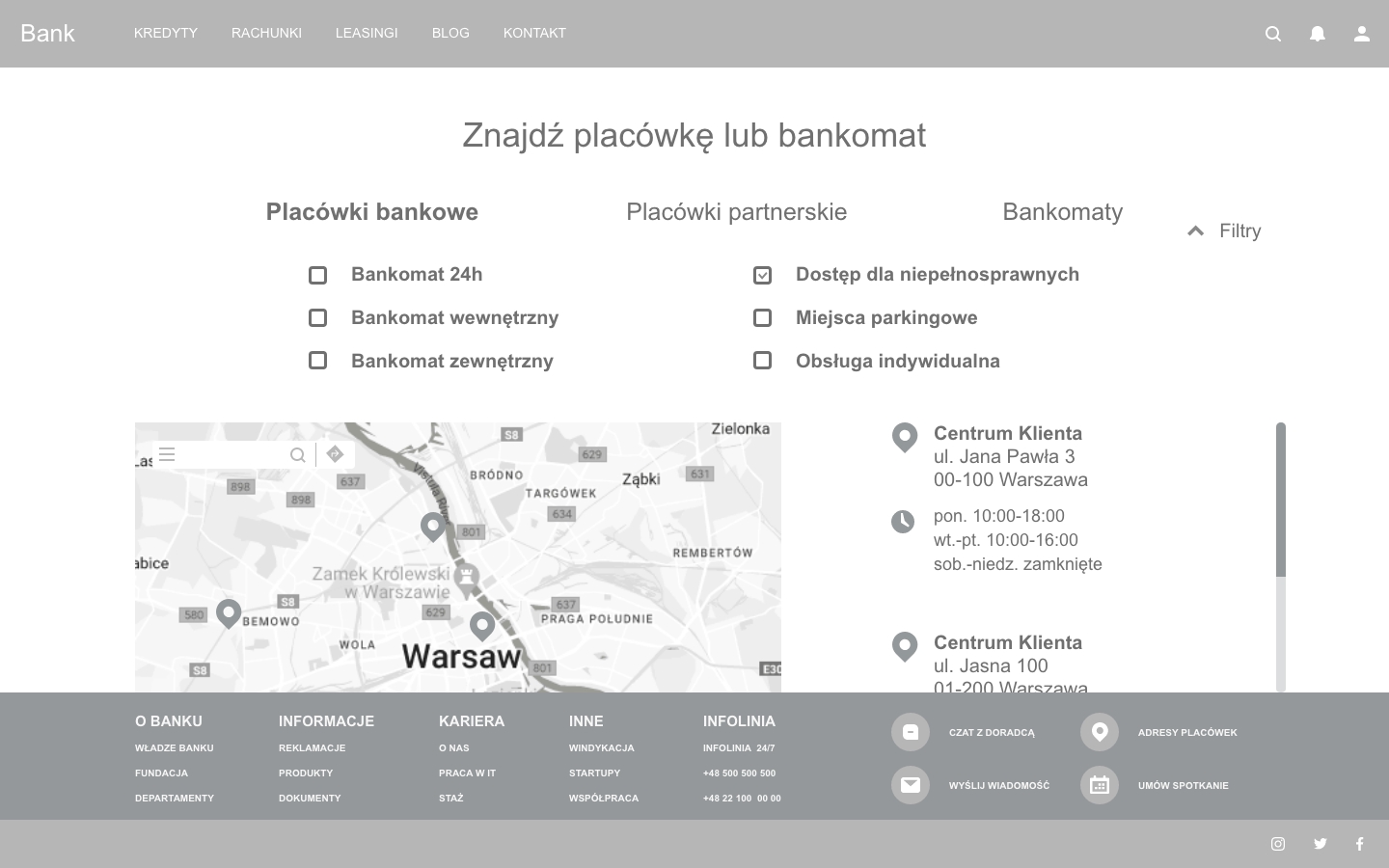

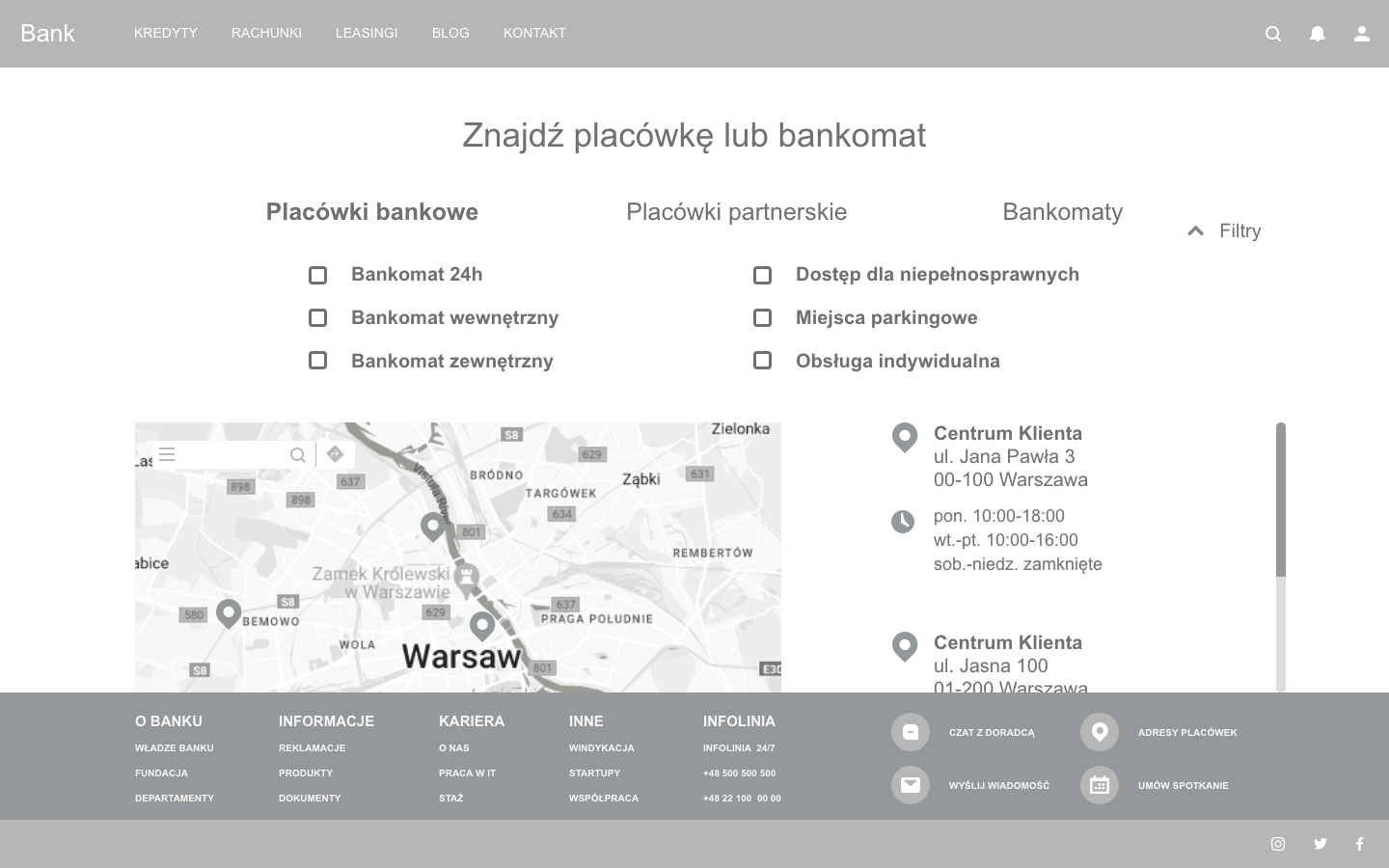

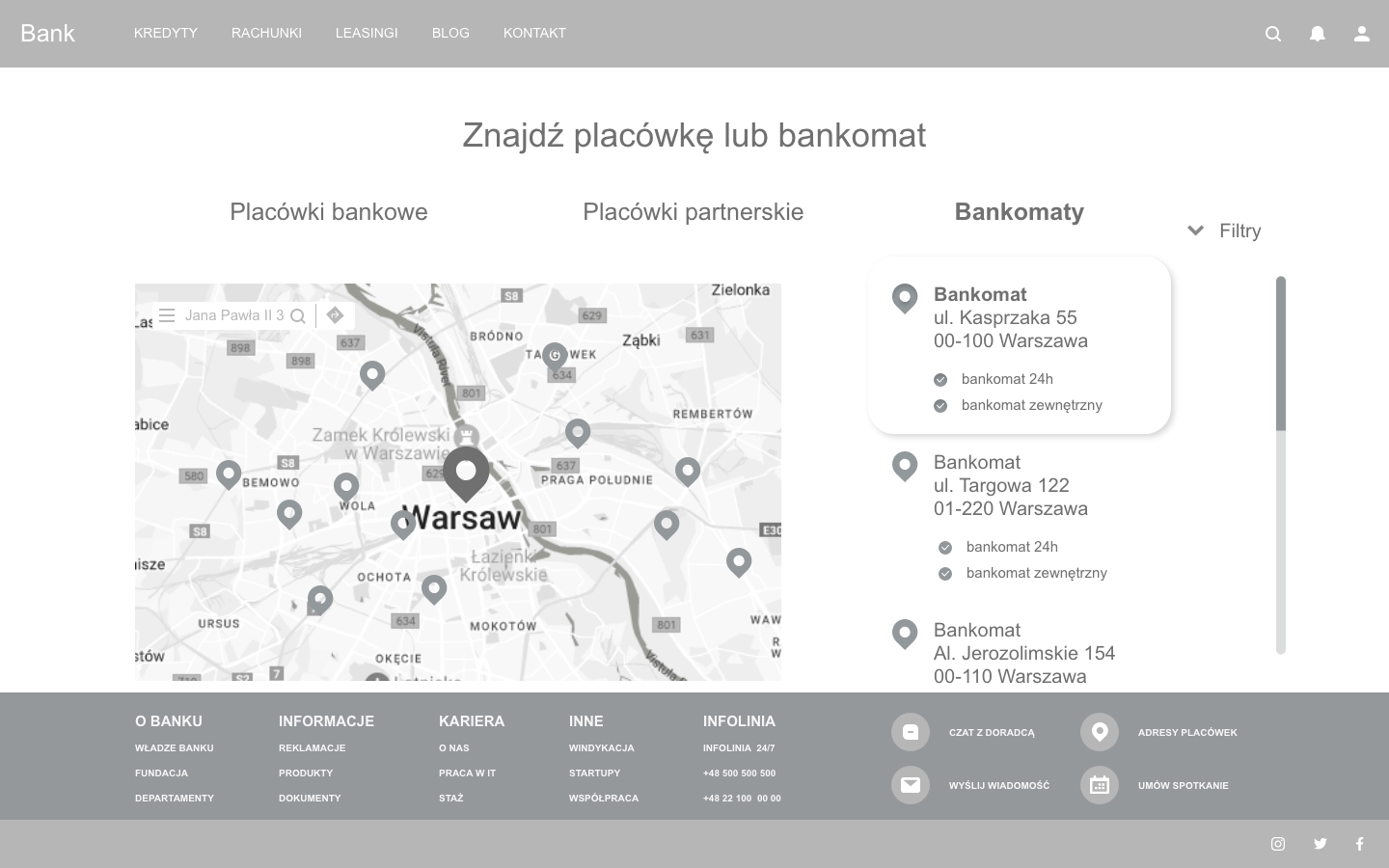

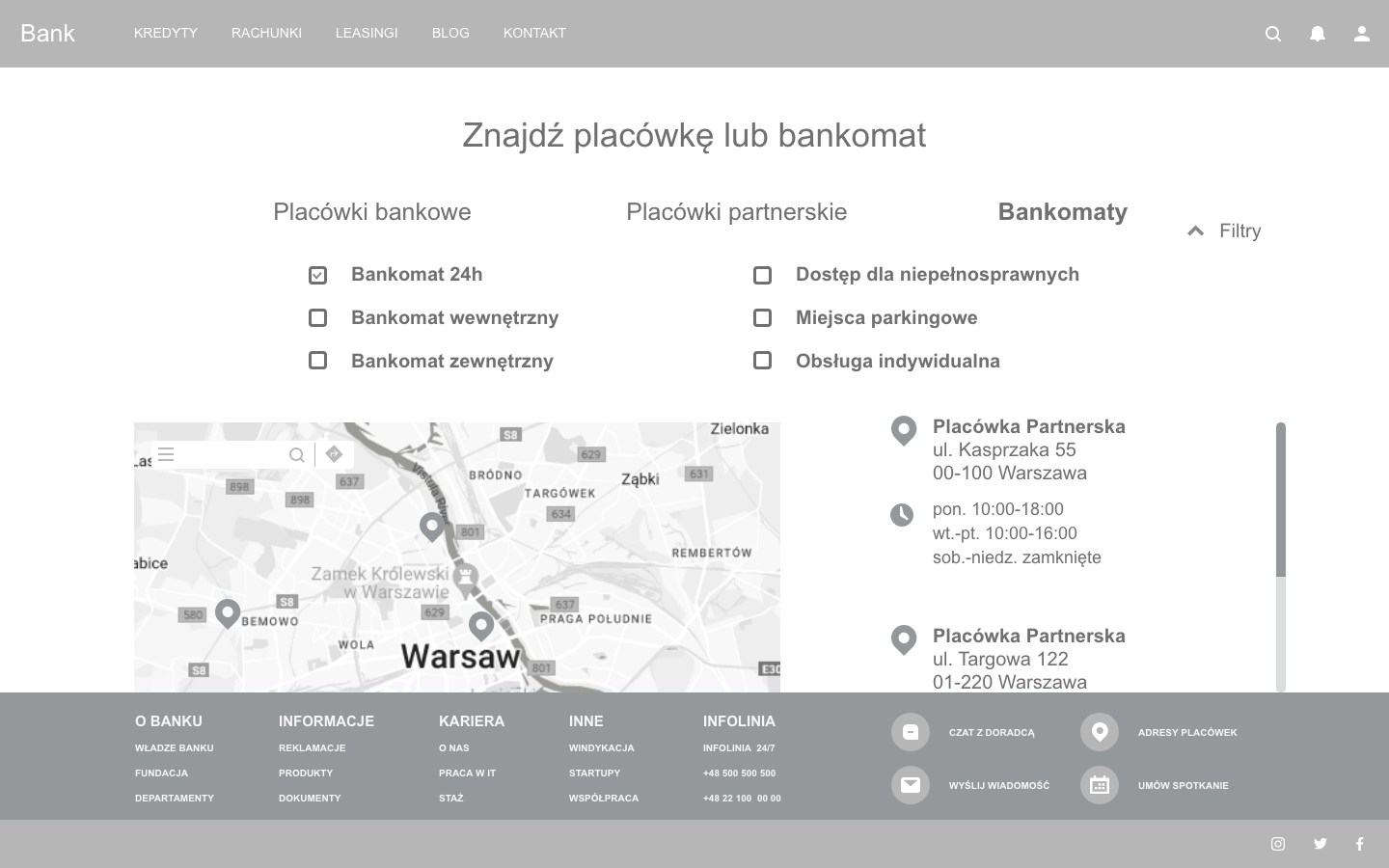

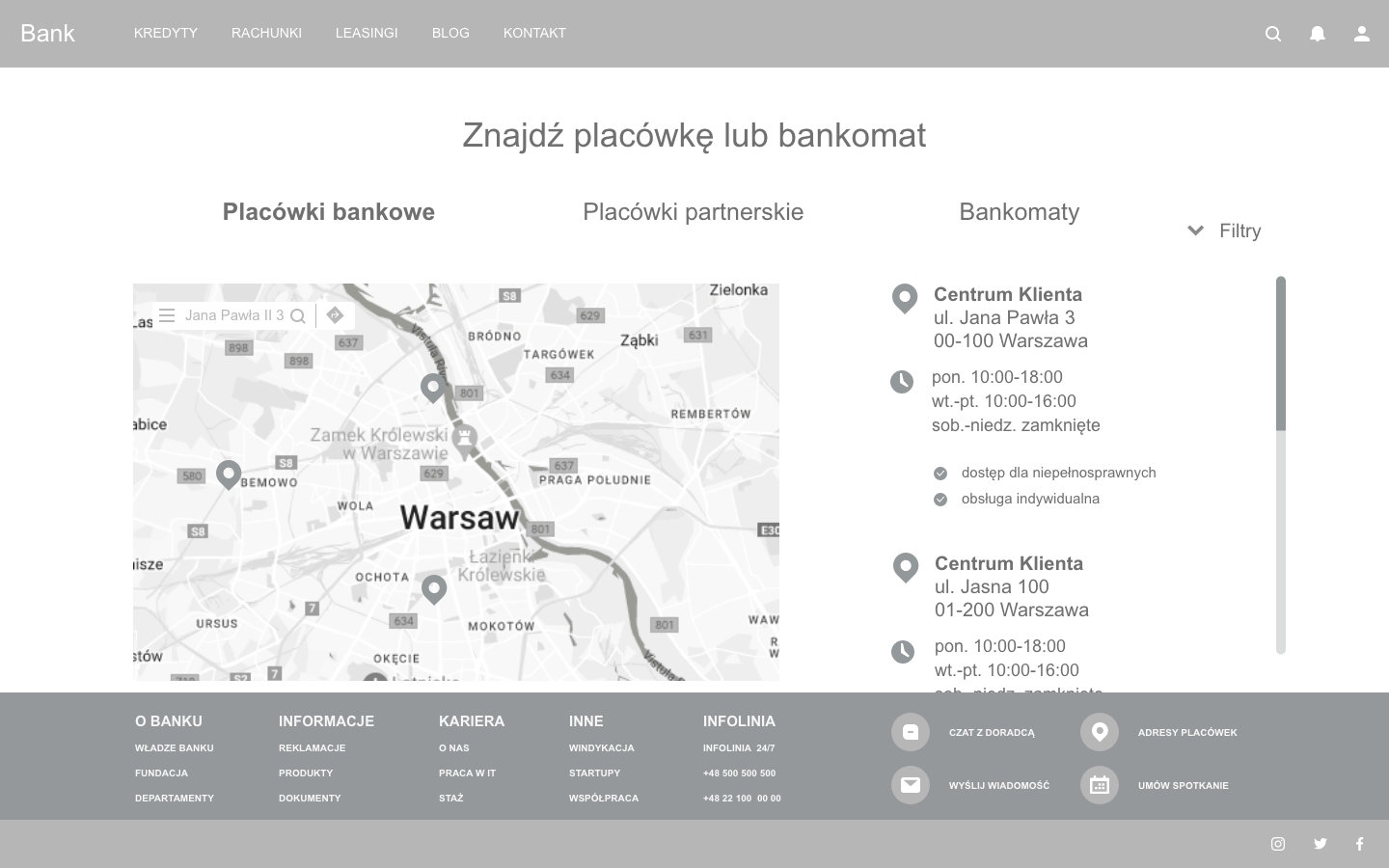

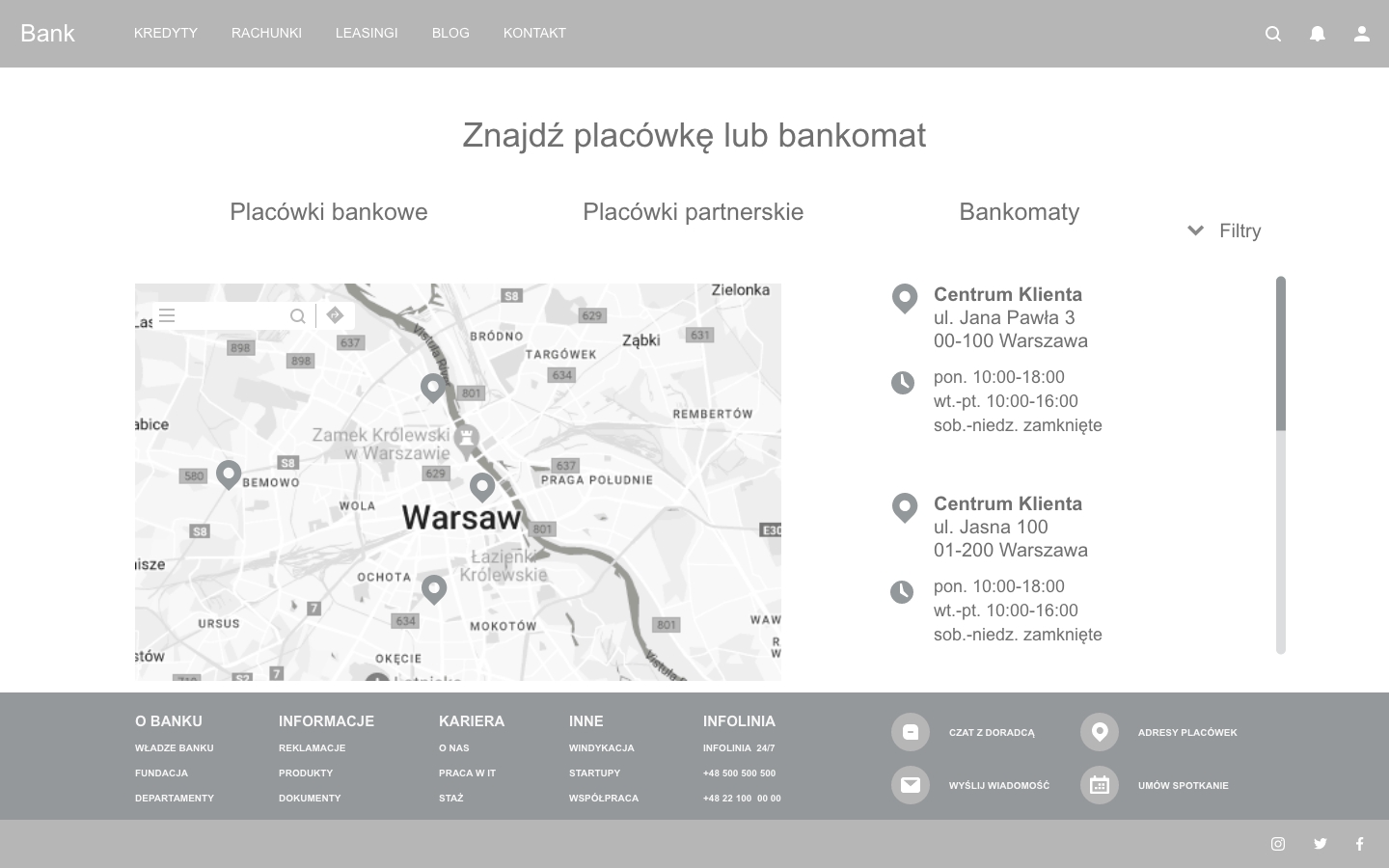

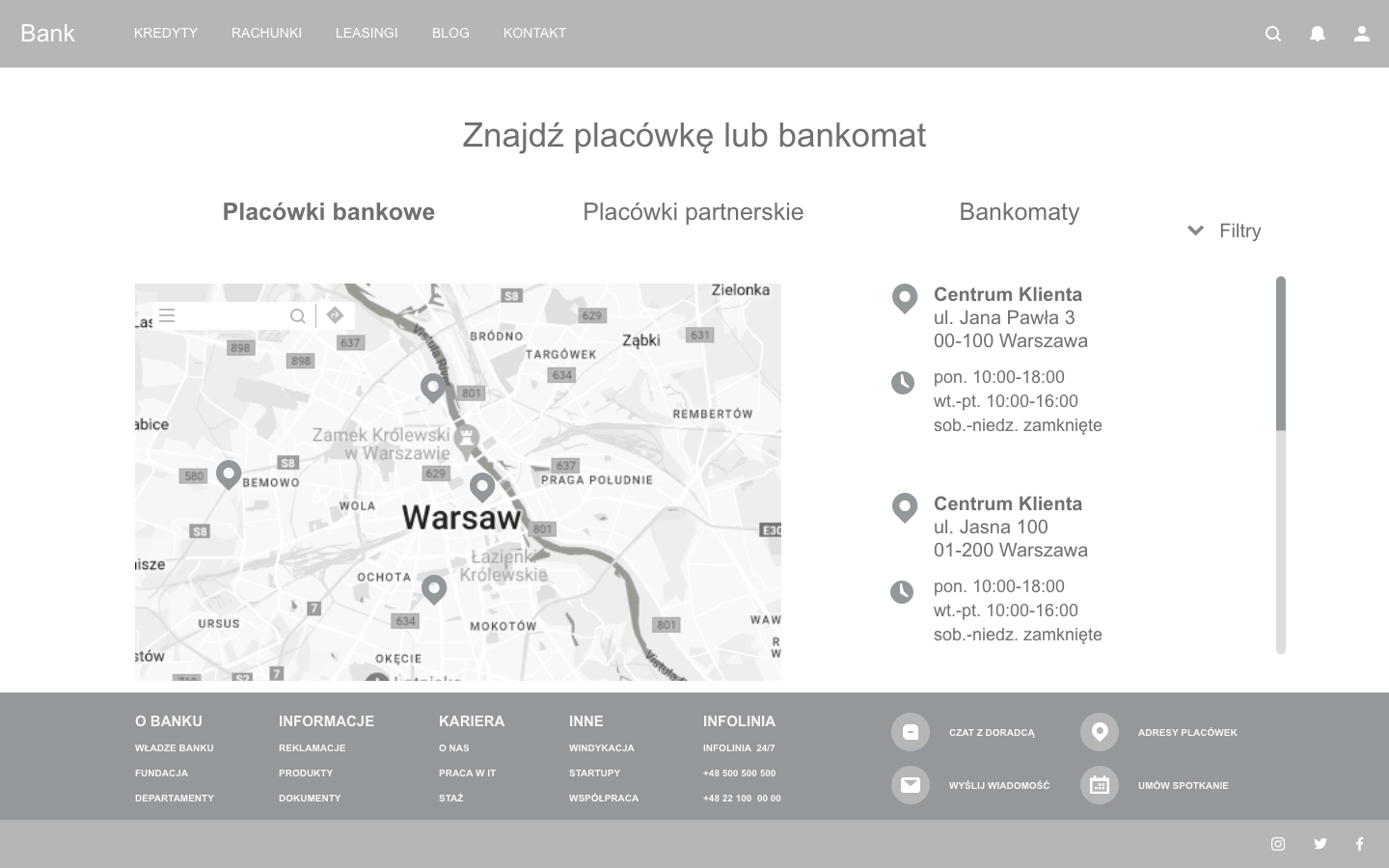

Hi-fidelity & Interactive Wireframes